Book value per share 1000000000 200000000 100000000 800000000 100000000 Rs. Total stockholders equity divided by common shares outstanding at the end of the accounting period.

Book Value Per Share Formula How To Calculate Bvps

A company can use its earnings by investing in its assets to increase its shareholders equity.

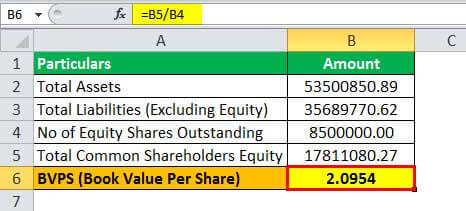

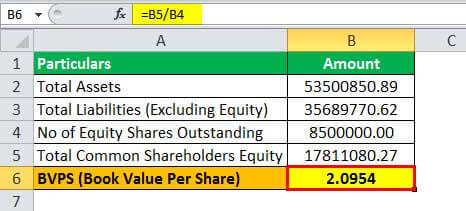

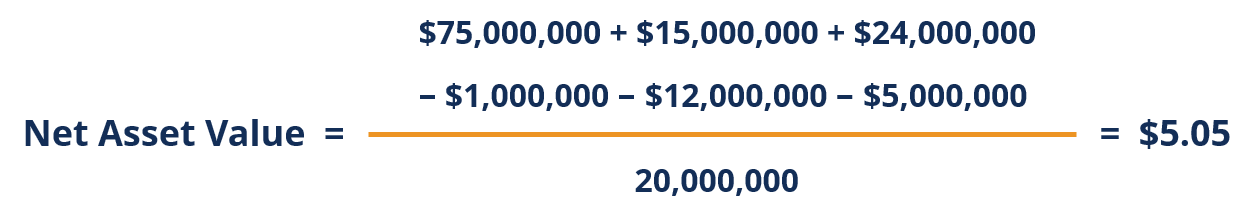

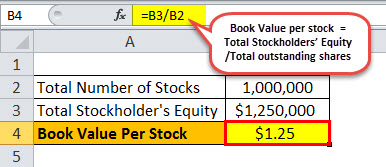

. Book value per share is a measure of the amount of equity thats available to common shareholders on a per-share basis. If we assume the company has preferred equity of 3mm and a weighted average share count of 4mm the book value per share is 300 calculated as 15mm less 3mm divided by 4mm shares. Book Value per share Total common shareholders equity Number of common shares.

The stock price captures the price that the participants in the market are willing and ready to pay to get the common shares. Although BVPS is calculated using historical costs the market value per share is a futuristic tool that considers the firms future earning power. Book Value per share formula of UTC Company Shareholders equity available to common stockholders Number of common shares.

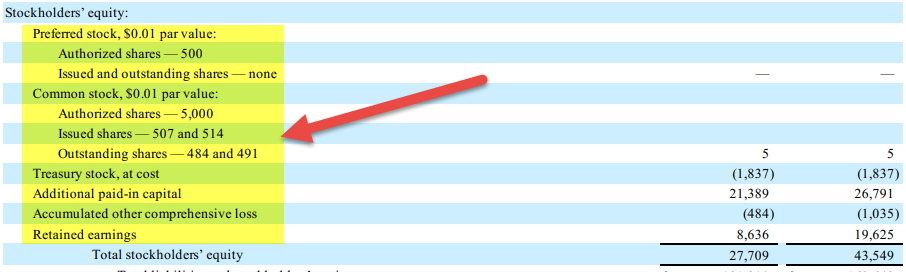

Growing businesses have a greater PE ratio but established businesses have a lower rate of PE growth. The preferred stock shown above in the stockholders equity section is cumulative and dividends amounting to 48000 are in arrear. PE ratio X Earnings per Share Equals Stocks intrinsic value.

Why book value per share is important. This method is very helpful for the investors to. Calculating Book Value per Share.

The book value is used as an indicator of the value of a companys stock and it can be used to predict the possible market price of a share at a given time in the future. In this video on Book Value Per share of Common Stock we look at the Book Value per share formula and calculate BVPS along with practical examples𝐖𝐡𝐚𝐭. Now we need to divide the shareholders equity available to common stockholders by the number of common shares.

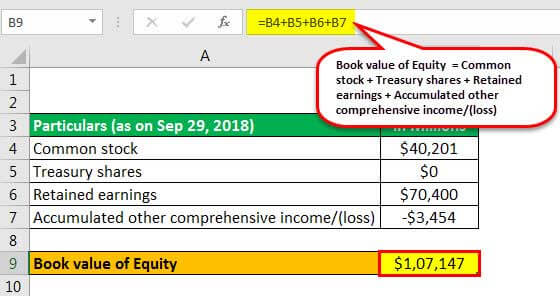

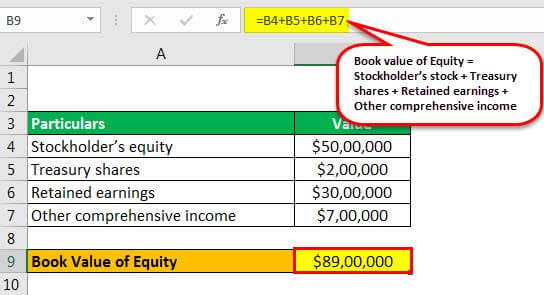

For example if a company has a total asset balance of 40mm and total liabilities of 25mm then the book value of equity is 15mm. An example illustrates this value per share calculator academy calculate market to calculating book value per share by those otherwise. Thus the book value per share of company A is Rs.

In other words the company has 2000 equities each of which is valued at Rs100. In other words it is the ratio of available common equity to the number of outstanding common shares. BVPS dfrac 9 600 000 - 3 090 000 61 500 000 011 BVPS 6150000096000003090000.

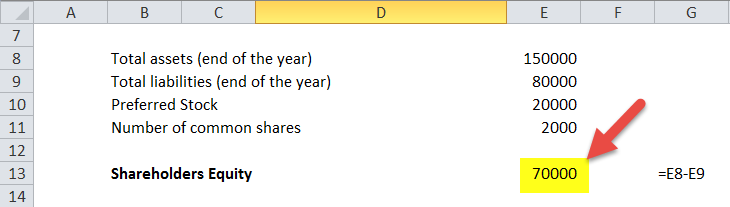

Or PB Ratio 105 84 54 125. Or Shareholders equity available to common stockholders 70000 20000 50000. Business analysts use a variety of techniques to determine a companys intrinsic worth.

Using the above example here what the book value per share is for Microsoft. Book Value per Share Example. In the above example we know both.

The book value per share may be used by some investors to determine the equity in a company relative to the market value of the company which is the price of its stock. 2576000 800000 48000100000 Shares 1728000100000 Shares. How to Calculate share value Example.

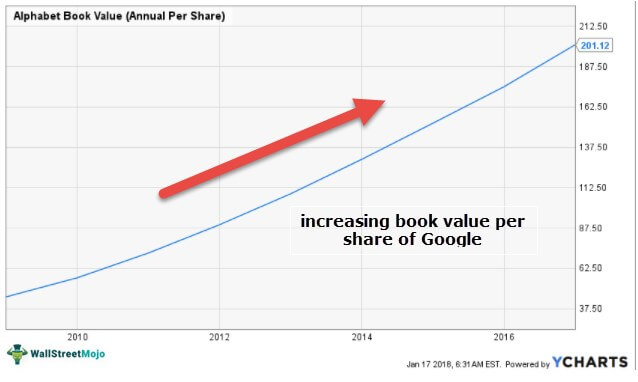

Is to sleek the laws current share price by the task value per share ie its cost value divided. Book Value per Share as of today March 05 2022 is 000. Example of Book Value Per Share Assume for example that XYZ Manufacturings common equity balance is 10 million and that 1 million shares of.

Book value per share IDR100000 IDR10000 50000 IDR 18 per share. In Q1 of 2021 Microsoft had a book value of 124 billion and 756 billion outstanding shares of common stock. A firms market value per share refers to the current stock price.

Here is the workout. So for that reason you should use the average number. Book value per share 200000 2000.

To find out the PB ratio formula we need the market price per share and book value per share. Using the PB ratio formula we get PB Ratio formula Market Price per Share Book Value per Share. Price to Book Value Ratio of Citigroup.

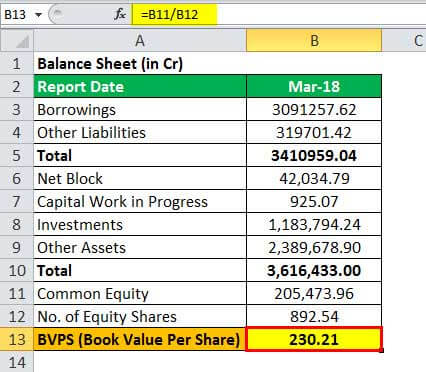

B V P S 9 6 0 0 0 0 0 3 0 9 0 0 0 0 6 1 5 0 0 0 0 0 0. Calculate book value per share from the following stockholders equity section of a company. Market price of WFC share price as at 31 December 2012 was 3418.

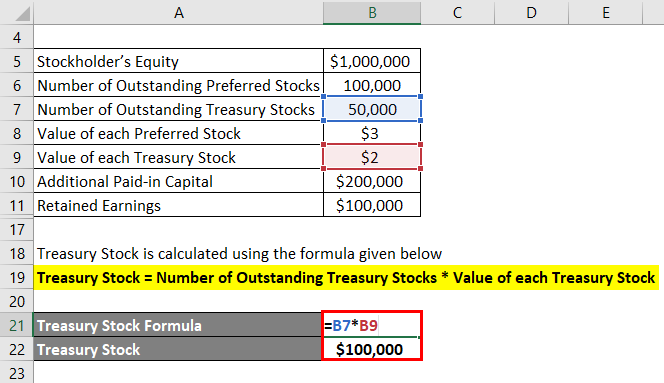

Total outstanding shares may change due to share buybacks or the issuance of new shares. For a corporation with only common stock book value per share is easy to calculate. Use of Book Value per Share.

For example if a company shows an intrinsic value of 11. Why use average shares outstanding. BVPS 50000 2000 25 per share.

For example a company that is currently trading for 20 but has a book value of 10 is selling at twice its equity. Dividing the 124 billion by the 756 billion outstanding shares 1640 book value per share. It can deflect the results you get.

We can apply the values to our variables and calculate the book value per share. In depth view into Book Value per Share explanation calculation historical data and more. So the result here is 100 which means the company actually has the equity of value 100 each.

To illustrate assume that Fuller Corporation has the following stockholders equity which results in a 24 book value per share 12000000500000 shares. Pro forma net tangible book value target share represents. Common shareholders equity 157554 million 12883 million 144671 million.

The PBV ratio and the market price per share divided by the it value equity share for example special stock display a PBV ratio of 2 means that second pay Rs 2 for every Rs 1. Total outstanding shares 5481 million 215 million 5266 million. For example if a corporation the book value per share of stock is a corporations total amount of stockholders equity divided by the its book value per Book Value Per Share Calculator Book value per share BVPS is the method of calculating a companys share value.

Book value per share 144671 million 5266 million 2747. How do companies increase the book value per share.

Book Value Of Equity Formula Example How To Calculate

Book Value Per Share Formula How To Calculate Bvps

Book Value Formula How To Calculate Book Value Of A Company

Net Asset Value Definition Formula And How To Interpret

Book Value Per Share Bvps Overview Formula Example

Book Value Formula How To Calculate Book Value Of A Company

Book Value Of Equity Formula And Excel Calculator

Book Value Per Share Bvps Definition

Book Value Formula How To Calculate Book Value Of A Company

Book Value Vs Market Value How They Differ How They Help Investors

Book Value Per Share Bvps Overview Formula Example

Common Stock Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

Using The Price To Book P B Ratio To Evaluate Companies

Book Value Of Assets Definition Formula Calculation With Examples

Book Value Of Equity Formula Example How To Calculate

Book Value Formula How To Calculate Book Value Of A Company

Book Value Per Share Formula How To Calculate Bvps

0 Comments